Law 2093 of June 2021 is issued, whereby Congress authorizes the territorial entities to impose surtax on gasoline under the terms of this bill.

In addition, the surtax on Diesel is created as a national contribution. This surtax will be collected by the Nation and distributed 50% for the maintenance of the national road network and another 50% for the departments, including the Capital District of Bogotá, for the maintenance of the local road network.

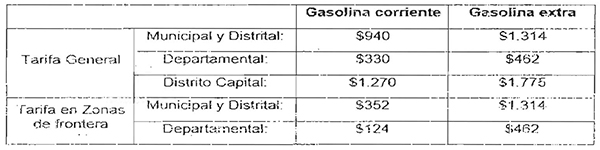

The taxable base is composed by the reference retail value of motor gasoline, both extra and ordinary, per gallon, as certified monthly by the Ministry of Mines. Fuel alcohol will not be included.

Regarding surtax on Diesel, it establishes that it will correspond to $ 301 Colombian pesos per gallon. For consumption in border municipalities, it will be settled with a rate of $ 204 Colombian pesos per gallon for the national product and $ 114 per gallon for the imported product.

The rates will increase as of January 1, 2023, with an annual variation of the Colombian consumer price index certified by DANE.