The Ministry of Finance published Decree 520 of April 6, 2020, modifying the dates for filing and paying income tax returns of large taxpayers and legal entities, as well as the annual statement of assets held abroad.

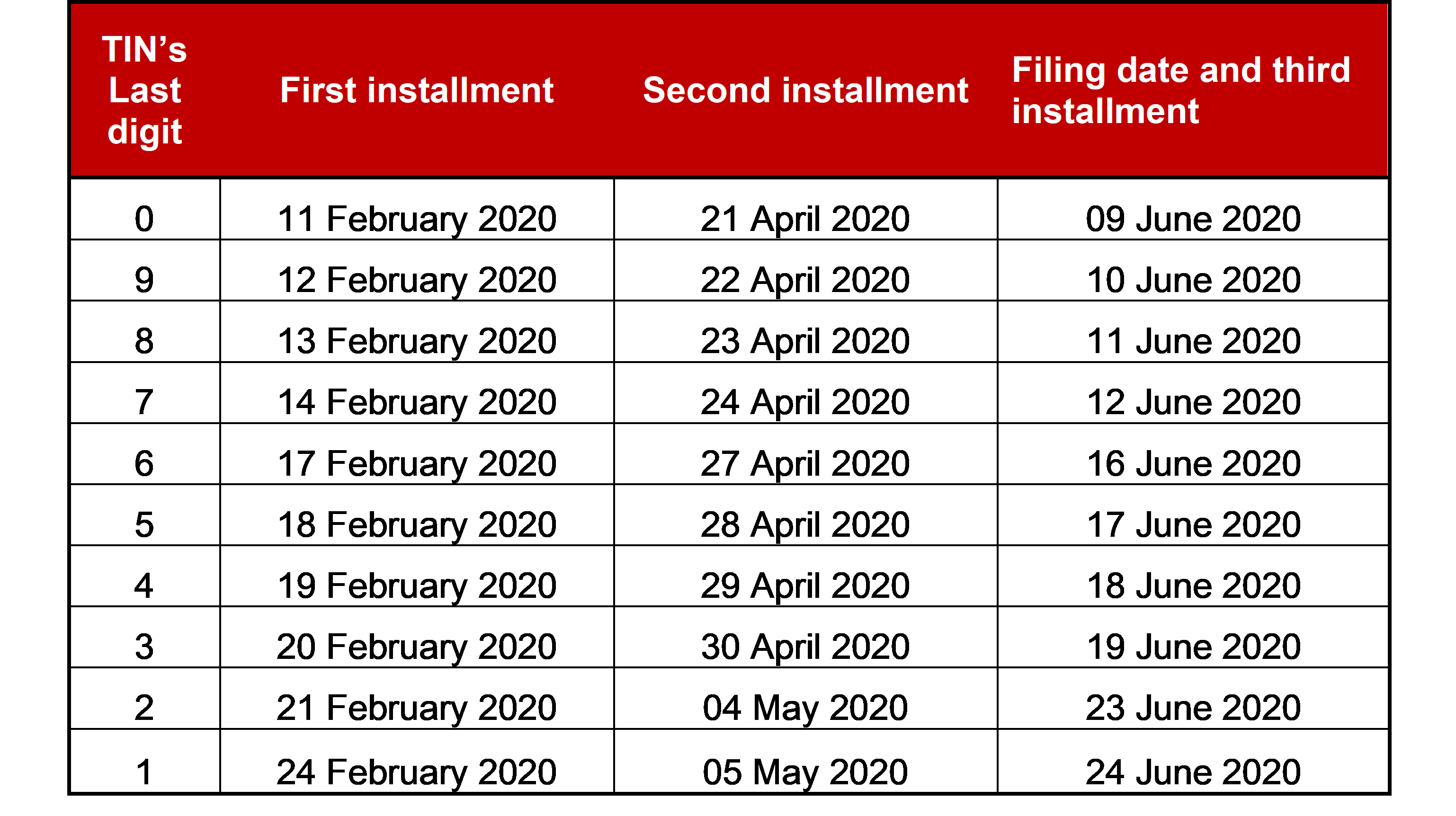

Accordingly, Decree 520 of 2020 establishes that the income tax returns of large taxpayers will be filed simultaneously with the third installment instead of the second one, as was previously provided by Decree 435, published on March 19, 2020. Thus, the dates for the presentation and payment of the income tax of these taxpayers are the following:

The Decree clarifies that the first installment may not be less than 20% of the balance payable in the taxable year 2018. Once the income tax and the advance payment of the tax on the respective return are settled, the amount paid in the first installment will be detracted and the remainder will be calculated as follows:

- The second installment corresponds to 45% of the balance to be paid in the taxable year 2018.

- The third instalment corresponds to the remainder of the payment of the first and second instalments. However, if the taxpayer filed the return together with the payment of the second installment, the taxpayer will take the tax to be paid, subtract the value of the first installment and pay 50% of the balance as a second installment, and the other 50% as a third installment. The payment will be based on the dates set forth in the table above.

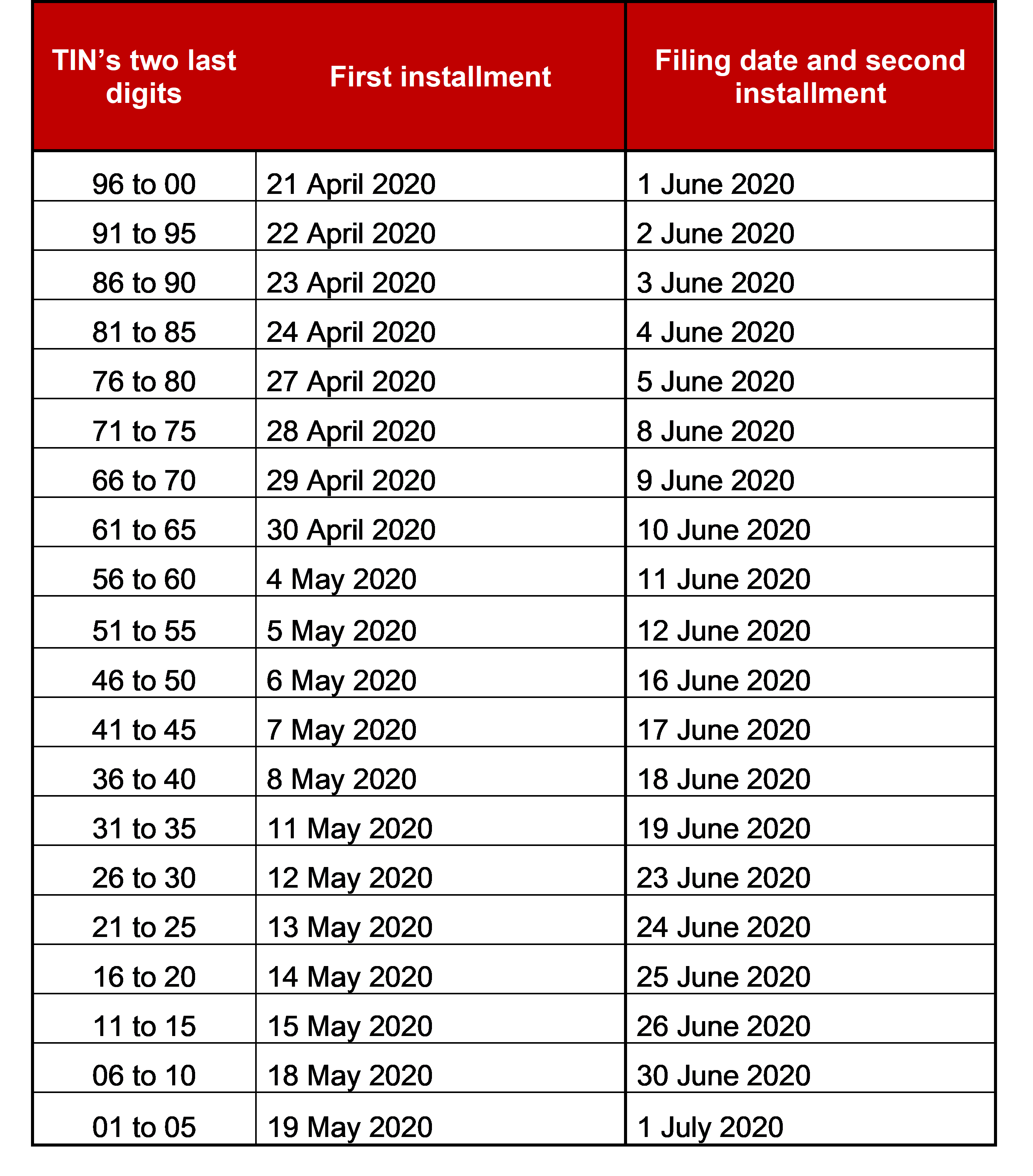

In relation to legal entities, Decree 520 of 2020 indicates that they must pay the first installment of the income tax return, equivalent to 50% of the balance payable in the taxable year 2018, between April 21 and May 19, 2020.

In contrast, the payment of the second installment will be due between June 1 and July 1, 2020 and will be simultaneous to the filing the tax return. In this way, Decree 520 of 2020 modifies Decree 435 of 2020, as it postpones the date of filing the income tax return of legal entities and attaches it to the payment of the second installment.

Notwithstanding, Decree 520 of 2020 notes that if at the due date of the first installment, the taxpayer has filed the respective return, the first installment will be equivalent to 50% of the value to be paid in that return, and the remaining 50% will be the payment of the second installment.

Below are the dates of presentation and payment:

Finally, Decree 520 of 2020 states that for both taxpayers, i.e., large taxpayers and legal entities, the filing dates for assets held abroad will coincide with the filing dates for tax returns. Therefore, for large taxpayers the filing dates will range from 9 to 24 June 2020, while for legal entities, the filing dates will be from 1 June to 1 July 2020.